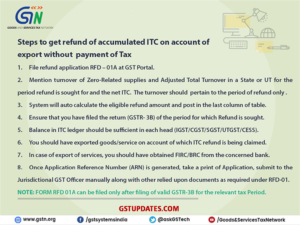

Steps to get refund of accumulated ITC on account of export without payment of Tax

1. File refund application RFD – 01A at GST Portal.

2. Mention turnover of Zero-Related supplies and Adjusted Total Turnover in a State or UT for the period refund is sought for and the net ITC. The turnover should pertain to the period of refund only .

3. System will auto calculate the eligible refund amount and post in the last column of table.

4. Ensure that you have filed the return (GSTR- 3B) of the period for which Refund is sought.

5. Balance in ITC ledger should be sufficient in each head (IGST/CGST/SGST/UTGST/CESS).

6. You should have exported goods/service on account of which ITC refund is being claimed.

7. In case of export of services, you should have obtained FIRC/BRC from the concerned bank.

8. Once Application Reference Number (ARN) is generated, take a print of Application, submit to the Jurisdictional GST Officer manually along with other relied upon documents as required under RFD-01.

NOTE: FORM RFD 01A can be filed only after filing of valid GSTR-36 for the relevant tax Period.