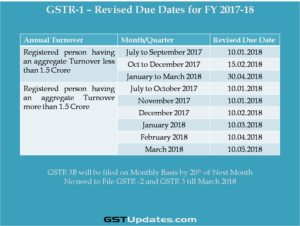

The due dates for the return filing have been extended yet again. The last date for filing for most of them is 31st Dec 2017. Again, due to the representation of the trade and industry, the government has extended the due dates again.

Notification No. 71/2017 – Central Tax

Notification No. 72/2017 – Central Tax

| Annual Turnover | Month/Quarter | Revised Due Date |

| Registered person having an aggregate Turnover less than 1.5 Crore | July to September 2017 | 10.01.2018 |

| Oct to December 2017 | 15.02.2018 | |

| January to March 2018 | 30.04.2018 | |

| Registered person having an aggregate Turnover more than 1.5 Crore | July to October 2017 | 10.01.2018 |

| November 2017 | 10.01.2018 | |

| December 2017 | 10.02.2018 | |

| January 2018 | 10.03.2018 | |

| February 2018 | 10.04.2018 | |

| March 2018 | 10.05.2018 |

Notification No. 73/2017 – Central Tax

The amount of late fee payable by a composition taxable person is Rs 25 per day after the due date where the tax payable is there, and in case of nil return, it is Rs 10 per day.

Notification No. 74/2017 – Central Tax

Wherever there is a movement of goods, and the value of the goods is above Rs 50,000 e-waybills are required in case of supply of goods and for reasons other than supply (job work, movement of material on returnable gate pass. Etc.,) is 1st of February 2018. This replaces the existing issue of e-waybills notified by various states.

Notification No. 75/2017 – Central Tax

CGST Rules are amended for the 14th time after the rollout of GST for smoother operations of the business and also add new provisions.

Form GST REG-10 – has been enabled for registration of person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered person.

FORM GSTR-11 – statement of inward supplies to filed by persons having Unique Identification Number, registration type.

FORM GST RFD-10 – has been notified for a taxable person having UIN to claim the refund on taxes paid on inward supplies.

Circular

Circular No. 26/26/2017-GST dated 26-12-2017

Government issued a Circular to clarify on various return filing process under GST and issues faced during such filing of returns. This Circular includes clarification on GSTR 3B, GSTR 1, GSTR 2, GSTR 3, GSTR 4 returns. Following major points shall be considered for filing of respective returns:

Clarifications in respect of GSTR 3B:

- GSTR 3B needs to be filed on monthly basis.

Late fees for the month of July to Sep 17 is already waived off and from Oct 17 onwards late fees will be applicable as under:

| Particular | Late Fees |

| Tax Liability is NIL | Rs 20/- per day |

| Tax Liability is not NIL | Rs. 50/- per day |

- Any error committed while filing GSTR 3B can be rectified while filing GSTR 1 and GSTR 2 of the same month. However, process of GSTR 2 is not yet operationalized and hence for errors committed in GSTR 3B can’t be rectified. Government has issued a detailed guideline in this Circular with examples on the following most common errors:

- Where Liability was under reported

- Where Liability was over reported

- Where Liability was wrongly reported

- Where Input Tax Credit was under reported

- Where Input Tax Credit was over reported

- Where Input Tax Credit of the wrong tax head was taken (e.g. CGST in place of IGST)

- Where Cash Ledger was wrongly updated

- Government has also clarified that GSTR 3B do not contain any specific table to report figures of past months and hence registered person must show such amount related to past month with figures of current month itself.

- GSTR 3B cannot have any negative entries so if after adjustment if any amount become refundable then registered person may claim refund of such amount.

- The facility to edit information can be used only before offsetting the liability and editing will not be permitted after offsetting the liability.